Would you believe anyone who says that data and digitisation doesn’t matter in their industry, because their domain is different?

Great suggestive question, I know, but the point is: You don’t. And neither do we.

So what’s our industry? Well, construction and mining on the one hand. But venture capital on the other. We believe data will change construction and mining and we believe data will change venture capital.

But here comes the cool part: Data and VC is not just a match, it’s a match made in heaven.

Big words? Maybe, but what is love without a little exaggeration. Besides, often it takes a second (closer) look to understand why the best matches are working so well.

So, let’s take that look!

Venture capital has been driving innovation and digitisation across industries, but ironically the VC industry itself can’t really claim they have been ahead here when it comes to their industry.

Today, VC still largely relies on networking and building relationships. Being in the right room at the right time (although COVID19 already raises critical questions about how this practice can be continued in the future).

To a large part this is due to the nature of VC itself. Young tech firms are private, information about them is scarce and thus valuable. And founders can only give so much of their equity until they lose control over their company, so there’s another scarcity.

No wonder why the industry keeps their cards close to the chest.

But there is another point, young firms are abundant. And they all look alike. Who would have been able to point out exactly that one garage in the 70ies where Apple was being built? It’s the notorious needle in the haystack (and the haystack is quite big).

So firms and VCs have been bundling up in a few hubs worldwide to be close to each other, to mingle. But this excludes everyone from the party that is not located around the corner and is therefore not able to quickly discuss some awesome new project over coffee.

This will change and has to change. The world is growing more globalised and the tech scene is growing with it. It will be more democratic, more inclusive and more fair. Data and data science will be a driving force of this change and thus it will not only be an add-on, but a must-have.

And here’s why.

VC is and has always been a fundamentally human game, but even more so it is a decision game. Ultimately it’s about making the best decisions concerning incredible uncertainty, given the very limited amount of information available.

We believe any major decision a VC takes in the future is underpinned with data and algorithmically prepared, seamlessly, enabling the investor to focus her attention where it is most needed and where the machines can’t help.

To make the point, we, of course, turn to the sector we love and know best: construction and mining.

There are three things about our beloved sector that you probably heard us telling everyone that is willing to listen and also everyone else:

The first is why Foundamental as a dedicated construction VC exists. Two and three make the case for data science.

We try to understand the hows and whys on-site, the processes on the ground and the local peculiarities, but also the global themes. We need to be efficient enough to cover developments in Bangkok, Barcelona, and Boston at the same time, while also being able to recognize patterns across them.

This is why a quarter of the Foundamental team were data scientists, when starting in late 2018.

After two years of obtaining, juggling, and connecting data as well as integrating it in our workflows we see clear results: faster and better decisions.

Here is the key take-away: Think data science as an enabler, not data science as a service.

After all, what type of language would the word “service” be in a marriage…

Our evolving platform helps us observing, clustering, sourcing, evaluating, and tracking deals. It makes our day-to-day work more efficient and transparent. It reduces wasted time and frees up human resources that can be applied in areas where humans are superior to machines (think of empathy, soft skills, or communication just to name a few).

Any organisation is a decision making machine. Humans are driving it, processes are the cogs and data is the oil. Did someone say “Data is the new oil”?

This is why data science can return even more value if it isn’t just focused on a decision, but on the decision making process. Meaning that any bigger decision (say, investing in a startup, for completely unrelated reasons) is always done in a context.

This context is actually a long chain of smaller and smaller decisions that everyone involved takes. Making any part of this chain of decisions more efficient and accurate, even only slightly, will therefore compound along the way.

And, the final outcome will be better. Any investor’s heart glows when hearing the term “compounding interest”, but it’s not just money that accumulates, it’s also efficiency.

(As a side note: Interestingly often a gain in efficiency has to be paid for by a loss of resilience. In the current pandemic this all too often got painfully visible. Also traditional VC processes are heavily affected by pushing more and more decisions to be done remotely. Tapping into more data sources here greatly increases the resilience of the decision making process.)

But let’s finish with the best part (yes, the best always comes last): as our key workflows are now based on and done through the platform, we create tons of data that allow for learning loops, making the platform not just efficient, but self-improving.

To drag the analogy along one last time: A good relationship is not just benefiting from each other’s strengths, it’s growing together.

This is artificial intelligence beyond the buzzword.

So, if you are equally passionate about how data is changing not only the industries VCs are investing in, but also VC itself, hit us up and join the ride. We would love to hear your take on it!

Most of us have been chilling , losing our mind, staying calm, operating as WFH professionals for the better part of the last two months. It remains to be seen just how much WFH becomes a part of a white-collar worker’s future if when things return to normal.

You know…the before time… when we might get to be a part of delightful conversations like this …

And while COVID-19 might be accelerating existing trends in the white collar economy, it might also lead to the backbone of our economies — The blue-collar workers powering industries such as trucking & transportation, construction , manufacturing and warehousing — playing an entirely different role in the future.

Here are my predictions for what this New World Order might look like

A trend that we had already started seeing in the before time was the relative and growing scarcity of blue collar workers in mature markets like the US and Europe.

Headlines like this…

or this…

…had starting becoming more common.

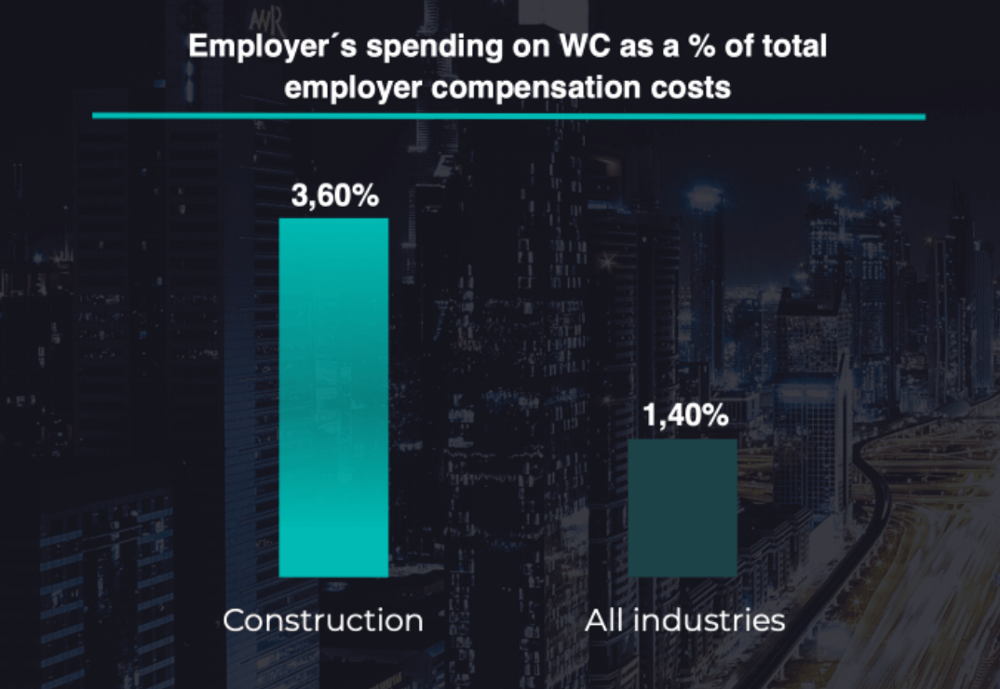

This is consistent with our own research which points to constraints in the blue-collar workforce for industries such as Construction. For example :

Clearly, construction and other blue-collar centric industries have been becoming less attractive to a younger, more millennial workforce.

(This clearly represents an important bottleneck, and one we will keep returning to in this article.)

But surely, you might think, COVID-19 will (continue to) hit the frontline blue-collar workers very hard?

Perhaps not.

Several market signals and first-hand data, especially from Asia, suggest an unexpectedly strong rebound in infrastructure projects and spend, with the backlog from the last 3 months possibly resulting in a “post-pandemic construction tsunami“.

The one catch : There aren’t enough workers.

Even in markets like India that have a huge labour surplus and a disproportionately skewed employer — labour ratio, news items like the one below are becoming more common with the resumption of construction in a post-lockdown scenario:

And this shortage is the most pronounced in industries that are highly dependent on blue collar labour, such as construction, manufacturing and logistics.

But have we seen something similar before ?

But of course we did !

One of the more long-term effects of the very scientifically named Black Death, was the acute shortage of peasants and urban workers in Europe.

So dramatic was the shifting of economic bargaining power in favour of the blue-collar workers that even though the rulers of the time imposed harsh punishments on workers demanding higher wages, there is clear evidence that worker wages and living wages improved considerably after the plague.

Might the improvement of the workers’ living conditions also have seeded the Renaissance Period ? And if yes, what might this signal for the future of workers ?

Will history repeat itself in the form of a post-pandemic world that offers blue-collar workers higher wages and greater financial security ?

However, it is prudent to remind ourselves that the higher wages paid to blue collar workers in the future will likely come with new strings attached.

Workflows which were largely executed using paper, face-to-face meetings and whiteboard sessions and phone calls/ messages will shift to being driven through remote collaboration tools (especially when blue-collar workers need to interface with white-collar workers) that are tailored for Blue collar use-cases.

While, on the surface, the use of digital collaboration tools might seem a trivial ask (especially for white-collar readers), it assumes and implies a certain degree of familiarity with the use of IT and digital tools — Something that is in fact quite unfamiliar to most blue-collar workers (and which is probably just one of the reasons why blue-collar professions are becoming less appealing to a more digitally-savvy millennial workforce)

Oh, and while we are on the subject of expecting our blue-collar workers to become adopters of technology, they will hopefully have no objection with adopting location and contact-tracing solutions as well?

With the blue-collar workers now expected to become proficient at using digital tools, what formal avenues could they turn to, in order to upgrade themselves ?

How about an expensive, full-time education program that requires all tuition costs to be paid upfront, might not ensure job-fit, and which also doesn’t necessarily deliver a positive ROI, right after a global pandemic makes the job market highly volatile ?

I know what you are thinking…

No wonder our blue-collar workers are highly circumspect when it comes to signing up for education/skilling programs.

But it doesn’t have to be that way.

As the likes of Lambda School and Scaler are showing in the White Collar world, the future of higher education for Blue Collar workers might be highly targeted 6–9 month programs administered digitally, require no upfront payment, and which are tied to future success through income share agreements.

And perhaps the need to seek out a learning cohort will influence a rise in labour union memberships, not just to seek collective security, but to foster collaborative and peer-to-peer learning in an “on-the-job” environment.

Ever heard the term “Gold Collar“? I hadn’t, until quite recently.

It was coined by Prof. Robert Kelley in 1985 to describe highly-skilled and essential knowledge workers whose value comes from brain power and mastery over their trade, and describes professions such as doctors, surgeons, pilots, lawyers and technologists (and probably does not include Venture Capitalists).

While it might seem like a stretch to suggest that Blue-collar professions could yield Gold collar capabilities, think of how auto mechanics levelled up to become Mechatronics experts as a result of highly focused skill development programs implemented in Germany and Japan.

What if similar skilling programs can yield a selective new genre of Gold Collar professionals that come with mastery over new / hybrid disciplines, mastery that makes them highly valuable knowledge workers , representing aspirational value for a millennial workforce that demands intellectual stimulation and social validation ?

At Foundamental, we have often debated if the typical Construction worker for the future will be a PhD.

Perhaps the equivalent of the future PhDs in Blue-collar professions will be highly sophisticated Gold Collar workers who will be prized for their brain power as employees, gig professionals and entrepreneurs.

If you are a Founder building for the Future of Blue Collar Work, we at Foundamental would be grateful to hear your story!

We’ve become quite enamored with exoskeletons

… if we’re being honest, ever since we saw Ripley dance toe-to-toe with Aliens on the silver screen …. “get away from her you b%$^… ”

& the multi-parameter value add such devices could proffer the construction industry.

A distant second, or third-order benefit could be a play to compliment new underwriting insurance structures & safety risk management applications to be birthed in the current construction-tech renaissance.

This got us thinking about the insurance industry & its dance partner, construction… What’s the tempo?… discordant partnership? … two left feet?

Let’s take a look …

Globally, 1,000 fatalities are recorded every day from occupational accidents, and that’s without counting occupational disorders. In both Europe and the US, ⅕ of these work-related fatalities are happening on construction sites.

In 2018, US construction sites accounted for 1,008 work-related fatalities. Moreover, according to OSHA, 10% of construction workers in the US received a work-related injury in 2019 and the Bureau of Labour Statistics reported that there are roughly 150,000 construction site accident injuries each year.

Every US worker is covered by Workers’ Compensation insurance, whereby medical expenses and time-loss wages are covered in the case of work-related injuries.

Given how each company/project is unique, one would think insurers write policies dynamically, and help institute a holistic safety & risk management platform.

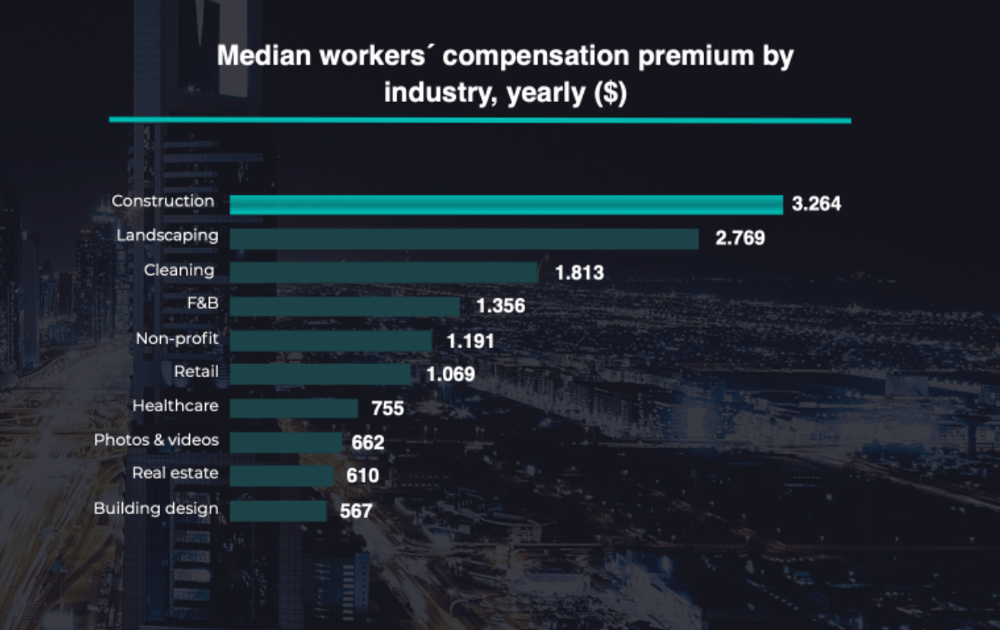

The truth is, insurance companies lack the data to do so. The pricing set by insurance companies for Workers’ Comp is based on an “industry-wide” classification rate, and does not take into account the risk profiles of individual construction sites.

As a result of this “one size fits all” underwriting process, the following pain points occur:

The status quo is broken.

Insurance firms lack the data and domain expertise to accurately assess risk, dynamically. In other words, construction and insurance are playing a game of telephone: speaking to one another albeit from great distances.

Data is a much needed antidote. And given the recent construction-tech renaissance, data is not an issue it once was.

“Peek not through a keyhole, lest ye be vexed”

-Stephen King

From AI to onsite cameras and sensors, millions of venture capital dollars have flowed into sophisticated tech companies able to both capture and process quality data from construction sites, real-time. Yet, this treasure trove of information is mainly being used to allay immediate business-related pain-points.

This is a stride forward as it builds a foundation of ground-truth enabling multiple stakeholders access to a shared set of facts. It’s our opinion: If there is no transparency, there’s zero accountability and if there is no ground truth we are in essence writing bad checks from our collective memory bank. Ergo: Memory is fallible (and limited) at the end of the day.

As referenced, there are new innovative solutions providing real-time visibility and transparency, tracking jobsite health to minimize schedule surprises and a select few providing immediate value during COVID-19 crisis tracking (labor) density & prolonged proximity. As an example: IndusAI, a Foundamental portfolio company, proffers such a look through a keyhole to make data-driven decisions with actionable insights whilstdecreasing time on claim disputes — providing end-users H&R Block-like “Peace of Mind” level of service— and subcontractor coordination.

This is our onramp to a high-speed highway for tiered services and solutions, leaving the old dirt road, connecting to the digital era. Similar to Google becoming the gateway to the internet because they answered your first question

…this is our onramp, turn right.

So far in the construction-tech space, companies have become increasingly successful in leveraging data for many services/solutions such as project management, internal collaboration and incident reporting to reduce rework whilst harvesting productivity/efficiency gains. At Foundamental, we’re searching for firms who are going through an evolutionary growth spurt — introducing new models into the ecosystem — by leveraging captured data in an entirely new way.

As previously established, and in our opinion, the solution rests with (actionable) data in the hands of those wielding domain expertise. Rather than looking at reinsurers who may expand their offerings into the construction industry, we believe innovation will spark & be orchestrated from the other side of the aisle: construction-tech firms evolving, building a ground-up solution to the insurance ecosystem. As such, we are inordinately interested in firms who can vertically integrate risk from the front line — literally from the gals/guys with the tools onsite all the way to the insurance industry. This takes domain expertise.

Similar to the waltz, someone must take lead; It is our belief that construction will take the lead given the highly specialized nature of the industry.

We have the What, the Why. We need the How.

More specifically: how can we solve the multi-pronged pain-points illustrated above?

The US market is full of companies that monitor and improve safety performance of construction sites: we believe these platforms will inevitably invite collaboration with the Insurance Industry. This provides reinsurers greater access to the specialized high hazard segment of the workers’ compensation segment.

Much like insurance, some safety monitoring companies are analyzing their data to capture the risk profile of various construction sites, on a real time basis, thus providing an entirely different yet compatible format to the insurance industry.

Hence, risk assessment on the basis of real-time field data is the key via which construction-tech companies can penetrate the insurance market.

Construction safety & risk management platforms can maximize the value of its risk assessment by playing an active role in the underwriting and pricing of insurance policies such as Workers’ Comp.

With risk analysis of live, individual projects, construction-tech startups with underwriting authority would have the ability to apply both tailored pricing and dynamic pricing to different construction companies, which isn’t possible for traditional insurers. In this way, the premiums faced by construction companies will be more in-line with their risk profile, not only passively monitoring & improving safety performance but directly contributing to their premium. As such, these new startups can renew the Workers’ Comp policies for “low-risk” construction companies at a discount rate, and keep the premiums high for high-risk companies.

In answer to the multi-pronged problem:

One way construction-tech startups can acquire underwriting authority is by becoming a MGU (Managing General Underwriter) i.e. a specialized insurance broker with key functions such as pricing, binding coverage and settling claims, sitting at the intersection of carriers and clients.

MGUs have been successful (in other industries) when markets signal a need for more specialized products, as their underwriting discretion allows for more product customization than traditional brokers. At Foundamental, we believe the construction industry is in need of a tech-enabled MGU business model as conventional safety & risk management platforms are saplings in infertile soil.

Safety & risk management platforms who can navigate to a tech-enabled MGU structure (with aim to pivot to a full-stack carrier) is an elegant (and defensible) evolutionary path to providing greater value to both construction & insurance industries alike.

We remain bullish on the blueprint design in its ability to alleviate festering pain-points that have yoked the construction & insurance industry. If you are a Founder building such a firm, Foundamental would be grateful to hear your story!

Big thanks to the Foundamental Insights team for uncovering unique nuggets of information for this article.

Sources:

At a recent panel discussion, one of my colleagues was asked how about a new and improved construction industry could deal with the global challenges of uncertainties in costs, and uncertainties with….you know…the Coronavirus situation (Sure, why not?)

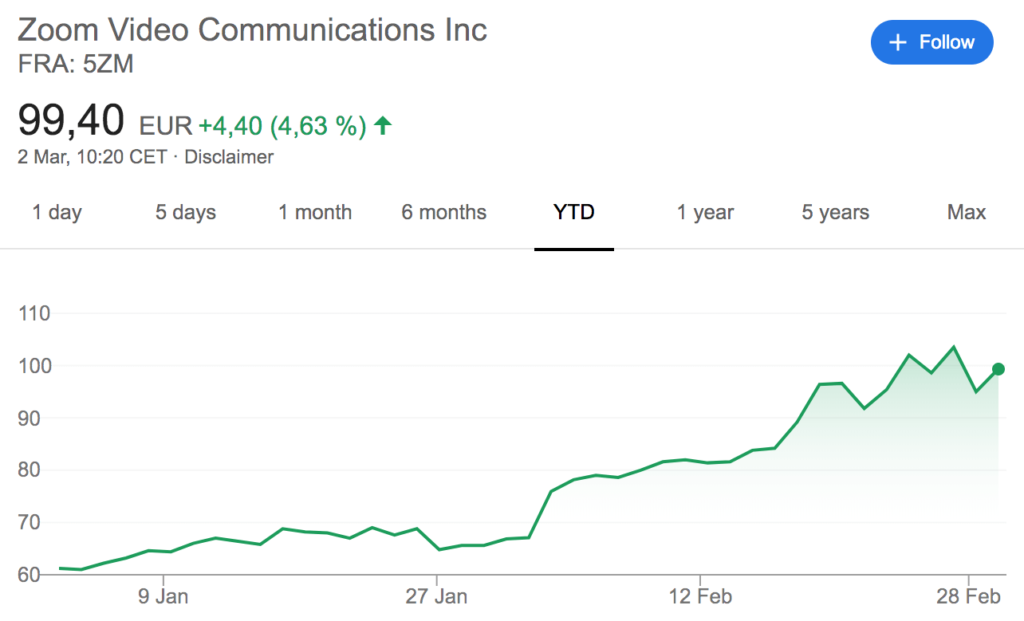

As Tech-VCs are wont to do when presented with such a question, I resorted to the #vclogic approach of bringing up obvious facts that have happened in the immediate past, and which most of you are probably already familiar with — That while most public market indices and stocks took a beating over the last month, Slack & Zoom gained ~50%.

This prompted the totally original and groundbreaking thought that the construction industry ought to be run on an open network, transparently connecting the world’s supply chain.

I know, you are probably thinking…

But to what extent are supply chains in Construction truly connected?

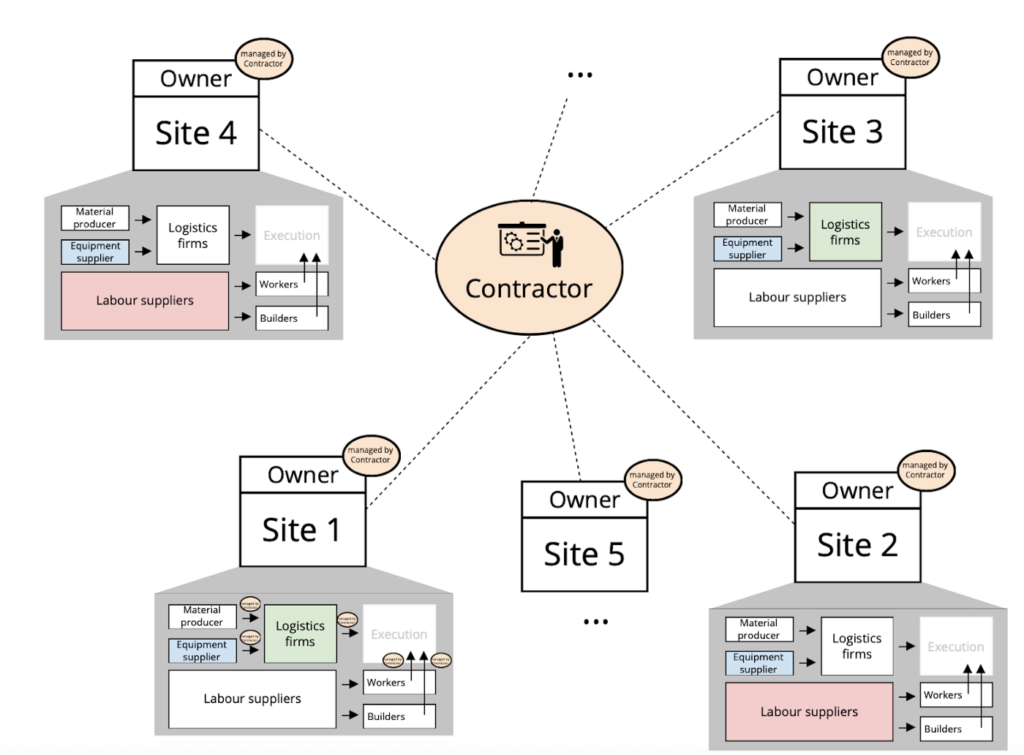

The truth, almost without exception in construction, is that the “supply chain” more closely resembles clusters of disconnected ecosystems that comprise players as distinct as owners, builders, material producers, logistics firms, equipment suppliers and workers & labour suppliers being held together in a state of delicate equilibrium.

As might be apparent from the above illustration, Contractors often don’t employ their own staff on projects and therefore, as a corollary, don’t actually “do” most of the tasks they have been hired for.

They instead hire firms, suppliers, and workers often for specific projects and engagements and “manage” the project.

You are probably thinking “Why hire a Contractor if subcontractors and suppliers do all the work ?“- A question that’s particularly relevant when reminding ourselves that the top 250 global contractors reported $1.5 Trillion in revenues in 2017.

In a very similar way, Contractors provide their project management expertise, their knowledge of building materials and methods, and their expertise in choosing subcontractors and workers.

But a Contractor’s greatest value-proposition, without question, is the promise of being responsible for the quality of work delivered, or the promise of delivering peace of mind.

And for the most part, Contractors do a great job in maintaining a semblance of order, in coordinating processes and stakeholder relationships.

However, as tends to be the case with so many industries and business models ripe for disruption (Threw that word in there for good measure), the strengths that traditional contractors represent (Locally/hyper-locally strong relationships and focus on execution/hustle) also expose just how fragile the supply chain in construction is.

It might surprise you to learn that most Contractors continue to rely on “low-tech” methods such as :

From our in-house research, we have identified the following pain-points in the traditional Contractor model that point to a pent-up demand for an alternative.

What if a new and emerging genre of firms is capable of operating with a different playbook that allows them to orchestrate construction supply chains?

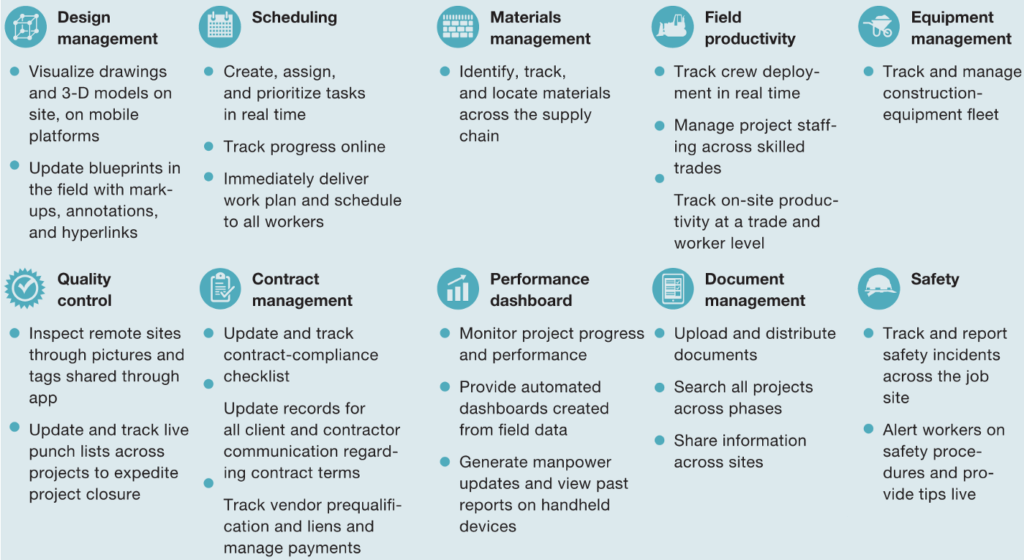

Before answering the question of what those firms might look like, lets take a look at the image below that describes the opportunities McKinsey & Co. identified for technology use-cases in the construction industry:

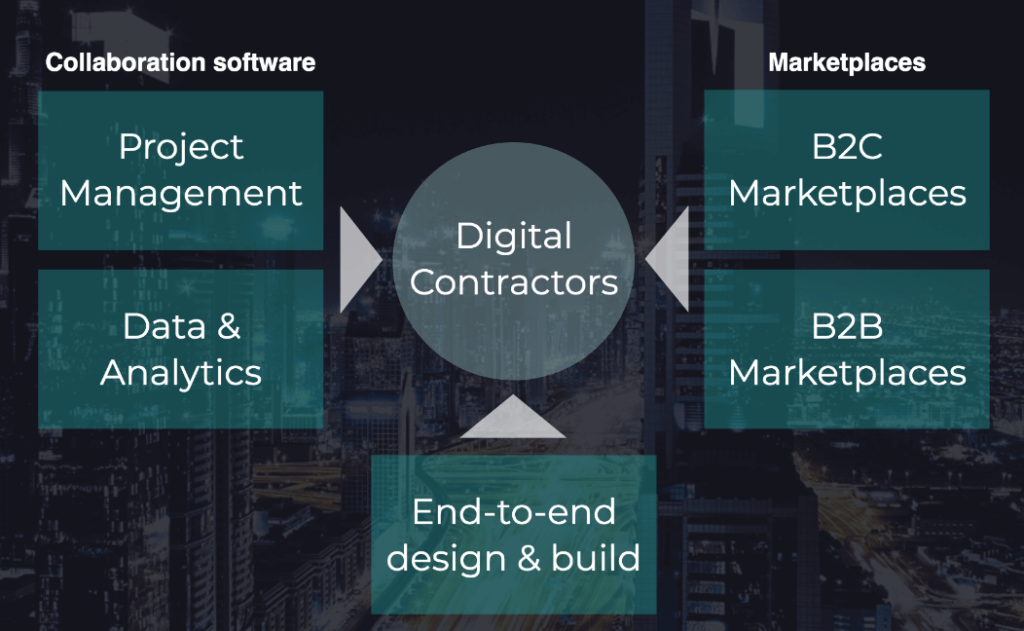

At Foundamental, we believe that a new archetype of firm will emerge in Construction to either directly solve the above use-cases, or effectively plug into other solution providers, one that we like to call “Digital Contractor”.

A Digital Contractor is a unique fusion of three very different business models, that have typically been thought to occupy three entirely distinct market opportunities:

We believe, and are seeing early evidence in multiple markets, that Digital Contractors “work” for the following reasons :

While the jury is still out on how our thesis on Digital Contractors will play out, we are very bullish on the model and its ability to (finally!) solve pain-points that have saddled the construction industry for far too long.

If you are a Founder building a Digital Contractor or want to create a firm that orchestrates the construction supply chains of the future, we at Foundamental would be grateful to hear your story!

Thanks to Foundamental.

If you follow us regularly, you know: we are investing globally in construction technology and building materials technology. Part of the reason why we choose to be global, cross-border VC investors is that it puts us in the position to identify patterns and indicators for emerging investment trends across the markets. Tiger Global has proven for many years how a truly global VC can achieve outsized returns.

The basic premise of our approach to identifying the big innovation opportunities in construction is that markets are complex adaptive systems. This means that the behaviors of customers and competitors are adapting to each other and to how the market evolves over time. The long-term outcomes of innovations are a result of how those emergent behaviors unfold in the market. We loosely define long-term as “more than 5 years out”. This long-term result is hard to perfectly predict early on because you have to get multiple assumptions right at the same time. Our friends over at Benchmark made this dogma famous:

“Throw that crystal ball out, you can’t perfectly predict anything. What you can do is discover when lightning strikes.”

— Peter Fenton, Benchmark

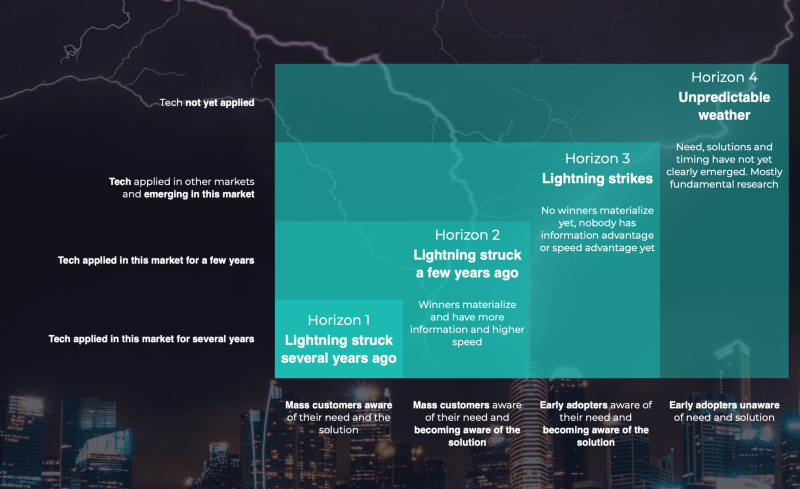

What we observed additionally is that timing plays a major role in picking rising tides and innovation opportunities. Big opportunities tend to emerge at the intersection of need<>technology<>timing. Timing is the often underrated factor. Consider these two examples:

In early-stage investing, timing is the hardest to observe. That also means: if we observe a ride rising in multiple construction markets at around the same time — or a few months after each other — we are significantly more likely to catch opportunities with outsized return potential.

What we have learnt is that timing can only be observed by being in close touch with the customers, entrepreneurs and experts in construction. We cannot observe from the desk when lightning strikes. We extensively use our network of construction experts and operators to validate whether venture opportunities we see in construction match with timing in the market — so far (as per March 2020) into more than 7’000 ventures in the construction sector across Asia, Australia, North America, Europe and Africa.

(Update December 2020: now at 12’000 and counting…)

Based on this data set, we recently refined our 10 principles how we go at discovering the rising tides in construction markets across the globe:

Markets are complex adaptive systems. For that reason it is impossible to predict with certainty the outcomes of any opportunity we see. Which of these opportunities will succeed and pay off will become apparent only during or after the fact, because their success will emerge from how the complex markets adapt to the innovations. Ergo: it is possible to discover success over time from within a portfolio of 30+ opportunities that create optionality. This is what innovation investors fundamentally do — they do not try to perfectly predict the outcome of any single opportunity, but they build a portfolio so they can discover which ones are becoming successful, and then double down on the winners.

Because markets are complex adaptive systems, our job is not to predict the future. Our job is to see the present very clearly. Our job is to observe the patterns that are unfolding in front of us. Our job is not to augur — our job is to observe when lightning strikes, and move decisively to benefit from it.

Gall’s law states: “A complex system that works is invariably found to have evolved from a simple system that worked. A complex system designed from scratch never works and cannot be patched up to make it work. You have to start over with a working simple system.” Any ultimately huge opportunity in the construction sector will look tactile and simple right now. For this reason, we are absolutely obsessed with founders who tell us a big tactile change they want to effect in construction — not an abstract or fringe idea.

Without a moat, competition will ultimately inevitably drop prices and compress margins to a point where there is no economic profit and the investments we made are burnt. In opportunities that appear certain because there are no emerging behaviors, competition will likely already be entrenched. No amount of defensibility can typically create outsized investment returns for us. We always opt to stay out of opportunity where there are no emerging behaviors. Instead, we look for spaces where we discover differentiating emerging tech, customers beginning to spread the word, and unique partnerships and business models emerging. And then we back the team that has what it takes to become the defensible #1 or #2 player in their space.

“What’s the number one form of differentiation in any industry? Being number one.”

— Marc Andreessen, Andreessen Horowitz

In picking growth opportunities we will face a business strategy trade-off: do we prefer opportunities with initially high margins over opportunities with initially low margins. Picking opportunities with currently high margins looks enticing. But: generally, higher margin opportunities in B2B tend to grow more slowly due to slower sales cycles and slower cash flow. This creates slower discovery and low optionality. Instead, it can be smarter to think about opportunities in ways how we can make them ultimately (not necessarily initially) defensible in order to increase margins at that point in time and how we can blitzscale them. Counter-intuitively, intentionally accepting low margins to increase fast adoption, growth and discovery can be the lower risk and higher return approach.

Technology outcomes are more linearly predictable than market outcomes. Ergo: we are more inclined to exploit big opportunities where we begin to observe emerging market demand and where technology can provide us defensible advantages, than accepting opportunities where market demand is entirely unclear and where technological differentiation is hard to achieve.

Because markets are complex adaptive systems, there are probably three to four things out of ten we can control that matter for the success of our growth opportunities (we stole this with pride from our friends over at Khosla — couldn’t have said it any better). Our competitors will control another three or four. The rest are unknown to us before the fact (i.e. luck, believe it or not). For this reason, we must consider that our opportunities must be driven by people who excel at adapting in fast-paced adaptive environments and who have an outsized will to succeed. Only such people will allow us to grow and discover fast, and create optionality for us over time. The single most certain choice we can make before the fact is picking A+ people.

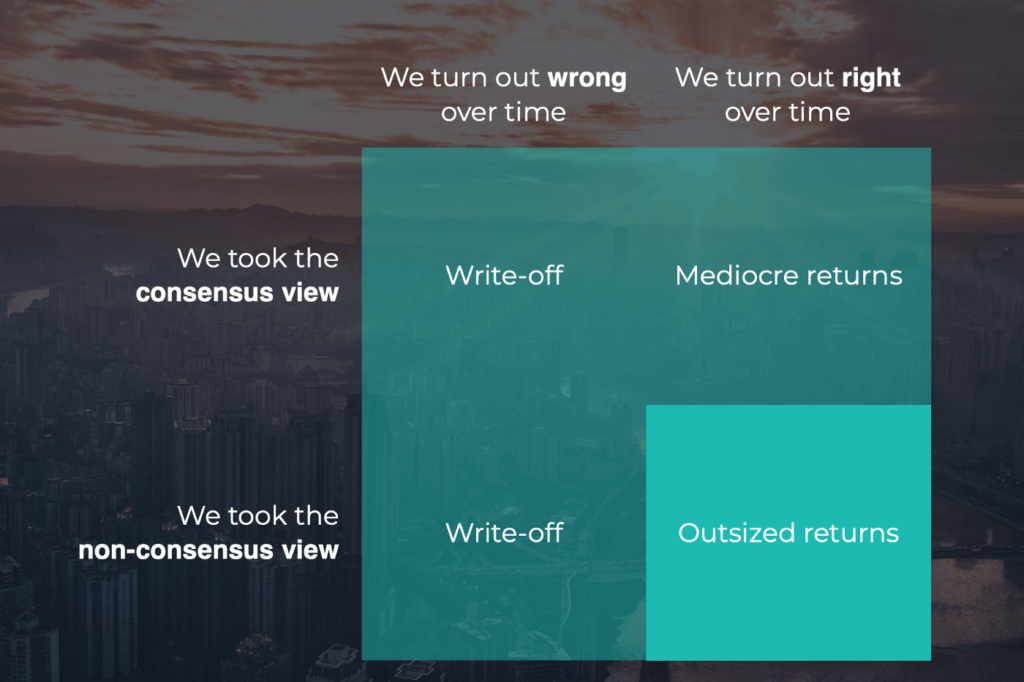

Returns of innovation opportunities strongly tend to distribute along a power law distribution (aka fat tail). This means that a handful of opportunities in the construction sector will generate outsized returns in excess of 40x on investment. 50% of all opportunities will usually be total write-offs. The remaining opportunities will generate low return multiples.

Power law distributions are the other key reason why a portfolio of growth investments is so important to discover and double down on the winners as they unfold over time. This is the single most important concept of investing in emerging growth opportunities. Any single opportunity without discovery and optionality is more likely to be on the low-return end of the power law distribution. Fast discovery + optionality + doubling-down on the winners.

Because innovation opportunities distribute along power law, and because markets are complex adaptive systems, the opportunities we go after must have the chance to be worth our while. In other words: each single growth opportunity we pick as part of our portfolio must be big and bold enough to generate outsized returns.

The problem is: we cannot outperform markets by starting with consensus views due to competition and information symmetry.

Ergo: we must focus on growth opportunities in which non-consensus edge views can allow us to outperform in the construction markets. Only over time we will discover which opportunities actually do generate power law returns. However, if we start with consensus views, none of those opportunities will generate power law returns for us and most likely we will not return our investments as a whole.

Zeckhauser’s Law states that when others know the likely outcomes of an opportunity better than us, chances are that those others will use this information asymmetry to our disadvantage. Ergo: we stay away from opportunities in which there are already people who can predict the outcome with high certainty when we can’t. Ergo: we only go after opportunities in which everybody (incl. ourselves) either does or does not know the likely outcome yet.

Let’s use the example of a B round to bring home our points. Imagine two companies we could invest in — and we are not yet existing investors.

Company 1 is in a space in which our observations tell us that winners will materialize in the near future — mass customers are aware of their need, and become aware of the various solutions. The tech has been applied for a few years. Now company 1 raises their B round to grow domestically, and existing investors would allow us to lead or co-lead their round. The problem is: as the space is nearing mass market, we are very likely at an information disadvantage over existing investors. Zeckhauser teaches us: if existing investors let us lead a such a round, we should assume that it is very likely that Company 1 is not going to be #1 or #2 in their market. Entering opportunities when they are in Horizon 2 is a losing territory.

Company 2 is raising their B round in a space that is a bit younger. The tech has been applied in other markets before (!), but in this market only for 2–3 years really (the company was fast). They commercialized so far on a few early adopting enterprise clients, and landed and expanded within these enterprise accounts. The question still is: when are mass customers going to begin adoption. Some kinks on the tech and product remain. 3 to 4 competitors exist. When we see a space like this, we can reasonably assume that inside investors are not entirely certain of the winner as well. What we try to do in such an opportunity is to identify patterns and winners from other global markets in the same space — and transfer those patterns to make a judgment on the likely further trajectory of Company 2. This gives us an information advantage. We love entering companies at such stages !

We call this stage Horizon 3. Horizon 3 is where lightning strikes right now at the intersection of need<>technology<>timing.

The above B round just serves as an example. We invest with our currently two funds from seed/pre-revenue through Series B, all the way. A Horizon 3 opportunity can exist at any company stage.

If you feel you are building the next big power law opportunity in ConstructionTech in a horizon 3 space — come talk to us !

The hype around autonomous vehicles (AVs) is real. And, frankly, it should be. With billions of dollars being poured into AVs annually (a whopping $4.2B invested in the first 3 quarters of 2018), we’d be concerned if there wasn’t a hype.

But, let’s be fair, we still have no clear idea when we’ll see fully autonomous cars, SUVs, RVs, pickup trucks, school buses, or beautiful sport cars on our city streets and highways (what we define as on-highway). On-highway autonomous vehicles will require well-developed and tested expensive lidar and radar systems, high tech infrastructure, and cloud computing and mapping providers to become fully operational and ubiquitous on our roads.

Currently, vehicles do not fall neatly into two categories of “automated” or “nonautomated” because vehicles on the road today have some level of automation. What we are referring to are vehicles that are classified by the Society of Automotive Engineers International (SAE) as Level 4 and, and perhaps even more so, Level 5 (see appendix at the end of this article for a description of all levels). Vehicles sold today predominantly fall into Level 1 and Level 2 of SAE’s automation rating system.

Some argue market-ready on-highway AVs of Level 4 and Level 5 within as little as 5 years. We at Foundamental argue that it will take longer than that. We shouldn’t only consider technology but also the required regulation and policy that needs to be legislated and enacted (which would be an entire article in itself).

So, this begs the question, will we see fully autonomous Level 5 vehicles this decade? The answer is yes, but we have to look in an unexpected place: off-highway.

“Some things are so unexpected that no one is prepared for them. “

— Leo Rosten in Rome Wasn’t Burned in a Day

An off-highway environment (think large heavy machines on a quarry or mine site) is more predictable, in a controlled setting, and requires less outfitted technology. We couple this with the fact that the industry will increasingly be impacted by labor shortages — placing the need for AVs front and center.

To really make a case that off-highway will lead the pack in terms of deployment, let’s take a look at the market and productivity gains.

At Foundamental, our insights team found that global construction unit sales in 2021 will reach 999,770 at a value of almost $90bn dollars — with India expected to hold the largest potential for future growth. Fully autonomous vehicles currently hold a market share of less than 1% of total construction equipment sales worldwide but given global equipment sales will grow 2.5% each year until 2022, coupled with the exponential growth in adoption of fully autonomous vehicles, the market share will likely double in size at least in the next two years. Fully autonomous sites are already common place in Western Australia (capturing 75% of global demand for autonomous trucks), with some other large scale activities in South America (Chile and Brazil).

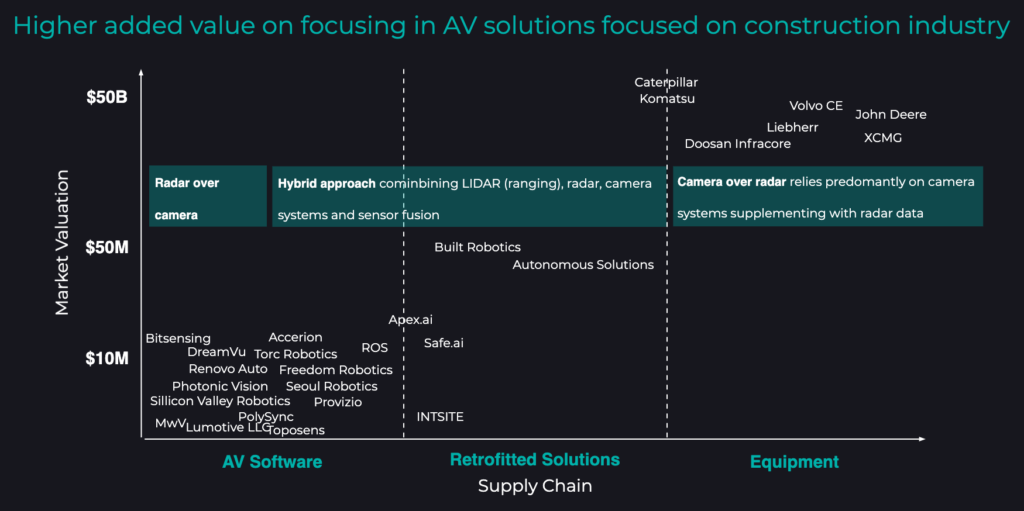

There is a critical mass of companies developing AV software and Original Equipment Manufacturers (OEMs) developing their own AVs with $50B+ market capitalizations that are ushering a new era of autonomous vehicle technology, albeit with varying tech focuses.

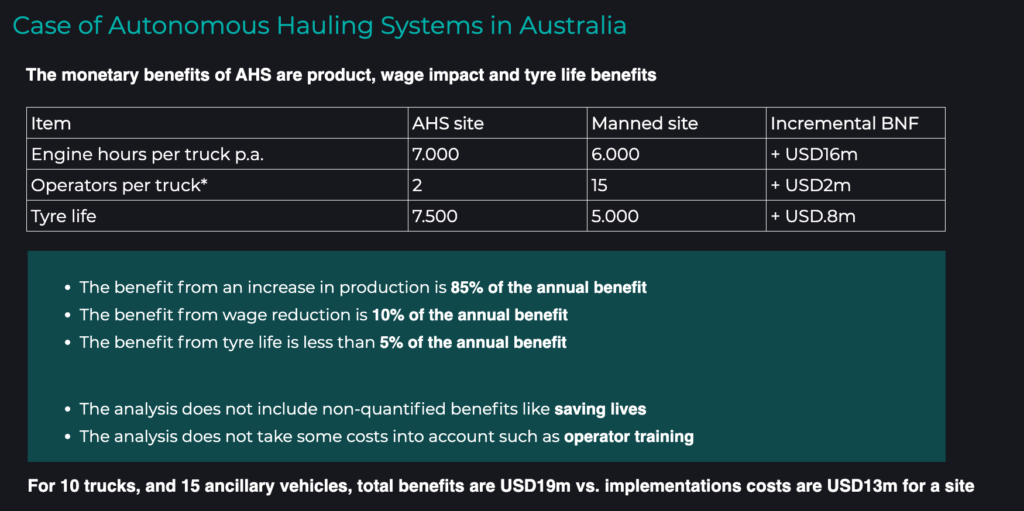

Compared to best-in-class manned operations, autonomous vehicles exhibit production benefit, wage reduction benefit and tire life benefit. We found an average increase in productivity of 30% via longer production hours (1,500–2,000 to 3,000 hours of operation by truck), reduced load and unit cost by 15% and improved tire life to 40% since optimized controls reduce sudden acceleration and abrupt steering.

The market is certainly there. The productivity gains are meaningful. Cost savings are realized. So, one might be wondering, is there a catch?

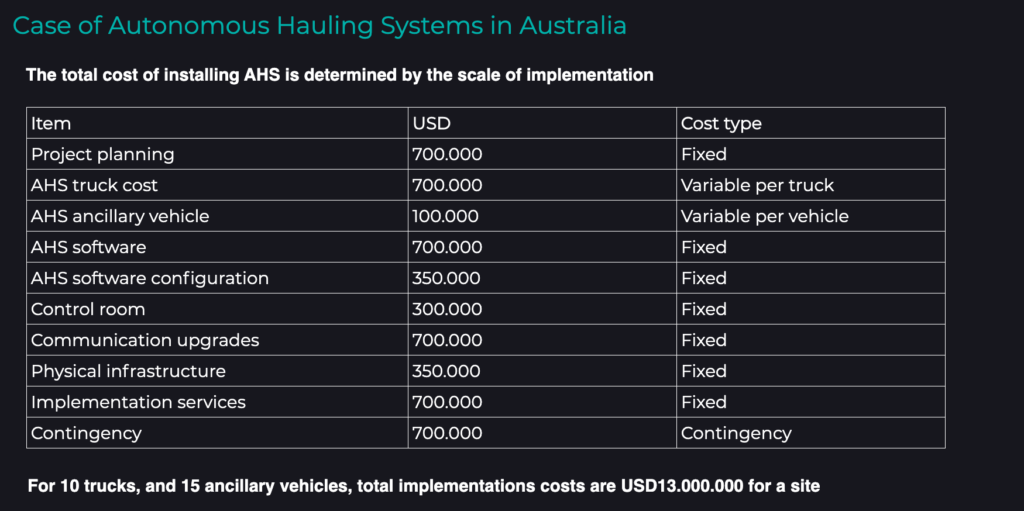

Vehicle pricing is an important challenge, specifically from a pre-operational cash outlay perspective and the economic viability of new projects. In 2018, McKinsey & Company announced that they expect fully autonomous 250-tonne haulage vehicles to be priced at up to $6M. From our own analysis, total implementation costs, assuming 10 trucks and 15 ancillary vehicles at a mine site, could be as much as $13M USD from data gathered from Australia.

This price would not necessarily be an obstacle for the larger mining operators, for example, with $50+ billion market capitalisations. But, smaller operators would be slower to adopt at this price point, if at all. The task is made even more daunting by the fact that autonomous technology is simply a part of a larger vehicle, so this technology is an expensive addition to a global supply chain that is already costly and complex.

It might appear at this point in the article that I somehow have disproved the point attempting to be made (and indeed the purpose of this article) that we should be looking at off-highway first in large scale AV deployment. Bear with me here. We’re getting there…

Our cost-benefit analysis reveals that there are substantial monetary benefits related to productivity, wages and tire life. While autonomous hauling system implementation would be on average $13M at a site with 10 trucks and 15 ancillary vehicles, the total benefits are calculated to be $19M. This indicates that investment into autonomous technology ultimately pays off. It’s increasing overall productivity of the site and addressing the skills shortage that plagues the industry.

We need to also address the growing market opportunity to retrofit current heavy equipment to become autonomous. We estimate the retrofit market to be approximately $3BN by 2022.

Cue: SafeAI. Off-highway autonomous vehicles brought to market by the major OEMs is only part of the equation to realize fully autonomous vehicles across thousands of sites this decade. End-users such as mine operators, aggregate producers, and construction general contractors want scalable autonomous solutions across a diverse mix of vehicle types and heavy equipment. Existing OEMs alone will not be able to get them there by exclusively offering new AVs.

Our portfolio company, SafeAI, is an example of a company providing a complementary product that is shifting market power to the end customer. SafeAI’s full stack autonomous ground vehicle software solutions for the construction and mining heavy equipment industry provides a retrofitted solution to existing heavy assets. The full stack solution includes 3D perception, teleoperation, autonomous operation, and fleet management. SafeAI’s aftermarket solution is sold both to OEMs and end users. SafeAI can functionally isolate feature sets for modularization and is able to provide a much needed piece to the AV puzzle allowing firms like Komatsu to really enter the OEM AV arms race. Assets that have a long life ahead do not need to be pre-maturely replaced for the sake of becoming autonomous right now. Or, more eloquently put,

“Don’t throw the baby out with the bathwater. “

While several operators, producers, or general contractors might not be ready to commit to a large CAPEX for new autonomous vehicles, SafeAI provides an OEM agnostic aftermarket solution at a lower price point than buying a new heavy machine on the market.

It should be noted that some OEMs, as well, retrofit existing assets. Caterpillar’s Cat Command for hauling, for example, is the current solution and market leader.

So, there you have it. Large scale deployment of off-highway autonomous vehicles will not be driven exclusively by OEMs or by companies such as SafeAI. Rather, the combination of new autonomous equipment sales and retrofits of existing assets will enable off-highway autonomy to be realized sooner and at scale before on-highway. The AV hype and rollout is real, we’re simply defining a possible way it will play out in the years to come.

SAE Automation Category Vehicle Function

Level 0

Human driver does everything (full-time performance exclusively by the human driver).

Level 1

An automated system in the vehicle can sometimes assist the human driver conduct some parts of driving (such as assisted steering or acceleration/deceleration using information about the driving environment).

Level 2

An automated system can conduct some parts of driving, while the human driver continues to monitor the driving environment and performs most of the driving (examples: Tesla Autopilot, Volvo Pilot Assist, Mercedes-Benz Drive Pilot, Cadillac Super Cruise).

Level 3

An automated system can conduct some of the driving and monitor the driving environment in some instances, but the human driver must be ready to take back control if necessary (example: Audi A8 conditional automation model).

Level 4

An automated system conducts the driving and monitors the driving environment without human interference but this level operates only in certain environments and conditions (all aspects of dynamic driving with no human intervention).

Level 5

The automated system performs all driving tasks, under all conditions that a human driver could.

Thank you to Foundamental’s Insights team for digging up critical golden nuggets of information for this article.