The European Central Bank raised interest rates a few weeks ago again, bringing the main lending rate to 3% and further closing the gap to the Federal Reserve.

I hadn’t had much time to write about it earlier, but I am deeply concerned from a societal perspective. How will thousands of families in Europe (and USA) continue to afford owning homes? Or is there a relief on the horizon?

(I’ll use German numbers below – many mature markets will show directionally similar dynamics)

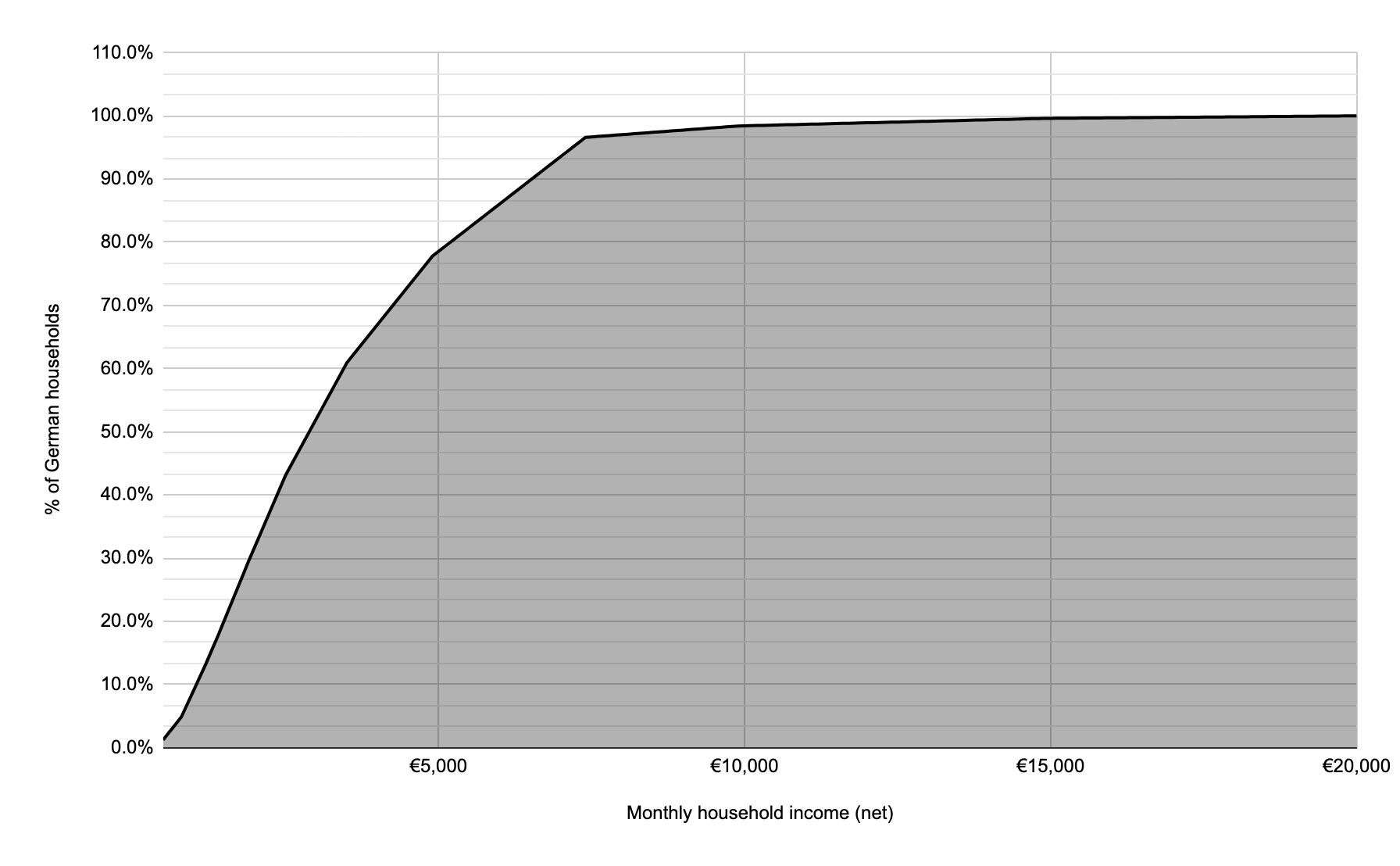

50% of households have a net income of €2’900 or less. 90% have €6’500 or less net available.

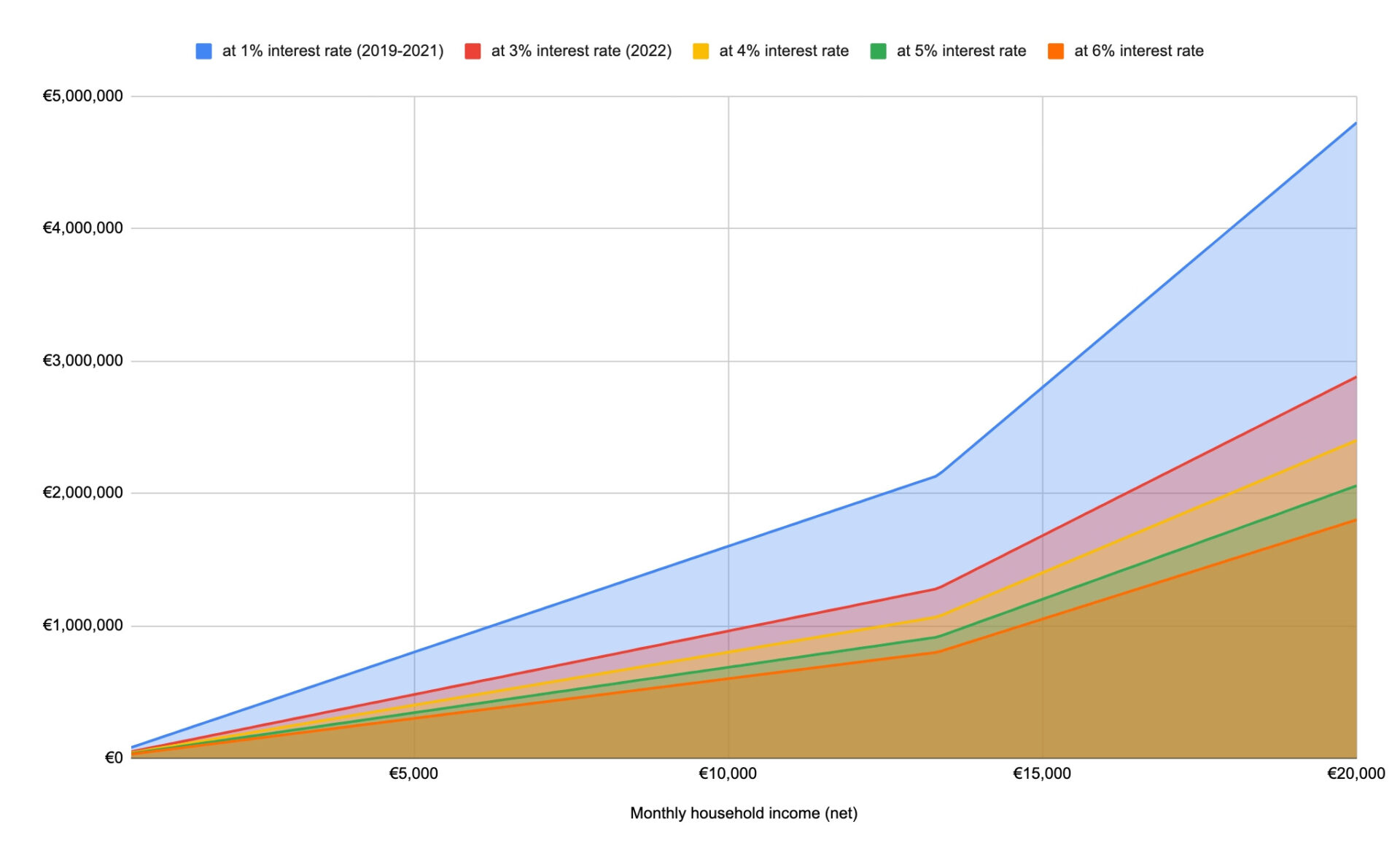

I was interested to analyze how much home households across the spectrum were able to afford in a low-interest rate environment (1% mortgage interest rates were commonly available until 2021 in Germany).

Then I wanted to understand how that affordability of home prices changes as interest rates increase.

For this analysis I used rules of thumb and mortgage assumptions commonly used in Europe:

Here’s how it looks:

As you can see, the affordability drastically decreases with rising interest rates. Between a 1% mortgage and a 6% mortgage, the home price that a household can pay is reduced by 63%.

If you now overlay the distribution of household incomes, you can make a very reasonable assumption that 90% of homes were purchased for €1M or less, the other 10% were possibly purchased above that.

Here is where it gets (depressingly) interesting:

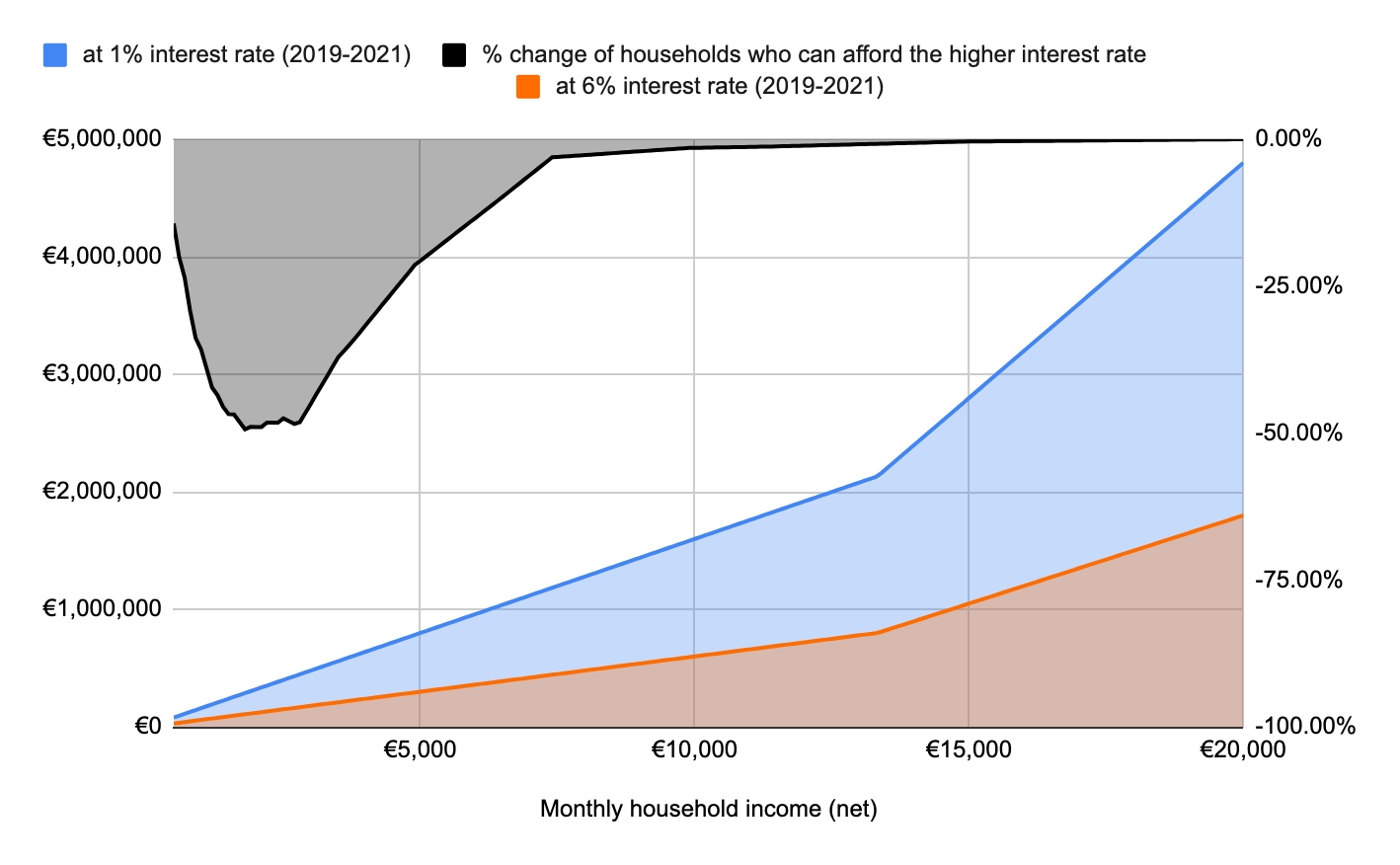

Flip the perspective, and ask yourself – how many households were able to afford a certain home price in a 1% environment (aka market size for that home category) and home many households in a 6% (adjusted market size for that home category):

For a home that is put on the market for €460k:

That means you have a 47%-points smaller market size for a home marketed at €460k between 1% and 6% interest rate.

And this is where it becomes a societal issue:

What you see here is that the change in market size happens in the low-mid home categories, by as much as -50%. While in the homes that households with upper-end net incomes can and will afford, you have practically no change in market size (0.5%).

Now, the first conclusion one could draw here is that home in low-mid price brackets could crash in price, while upper-end homes could be more stable in price. That is a reasonable conclusion.

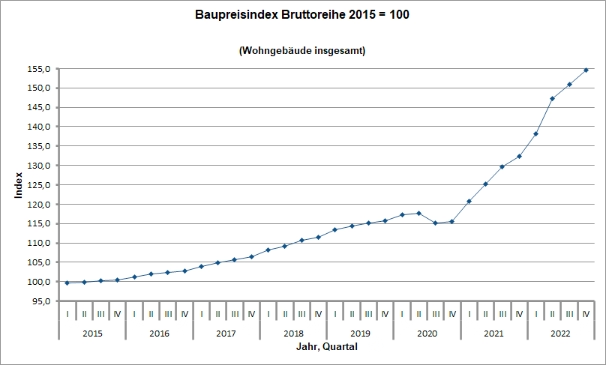

But the story doesn’t end here. Consider the cost of new construction, which is the equivalent of creating new supply in the market:

Unfortunately, construction cost keep escalating. This comes down to skilled labor shortage and availability (and prices) of materials. Regulation doesn’t make construction easier, but more complex. Thus, experts expect construction cost to keep rising.

Which means, we cannot expect new supply to flood the market and create relief in the form of widely available, cheaper homes – at least not immediately.

And this is the very concerning part:

I hope I will be wrong about this.

All my sources and calculations available here as open-source