The benefits of being a global investor is that we see trends and themes across markets but also become market insiders of what differentiates these markets from each other.

You might be thinking, “Yeah, so what?”. Let’s put it this way,

“To know that we know what we know, and to know that we do not know what we do not know, that is true knowledge.”

— Nicolas Copernicus

For the purpose of this article, let’s take CO2 in construction within European markets as an example to show how a global view helps.

Addressing the CO2 in construction problem will be different in Europe than in other regions. Tackling this challenge is not a “one size fits all” approach. The approach in Europe will and should be different than in North America or Asia.

So let’s get started — so you “know” ?

1/ Germany and most of Europe have a long-standing tradition of building “brick by brick”. When we compare the average residential lifetime of buildings across the 3 major regions — North America, Europe, and Asia — we find stark differences. In China, the average lifetime of urban residential buildings is 34 years (with the average being greatly impacted by massive new construction over the past 20 years), in North America it is approximately 61 years, and in Europe it is a whopping 120 years due to the solid brick building method.

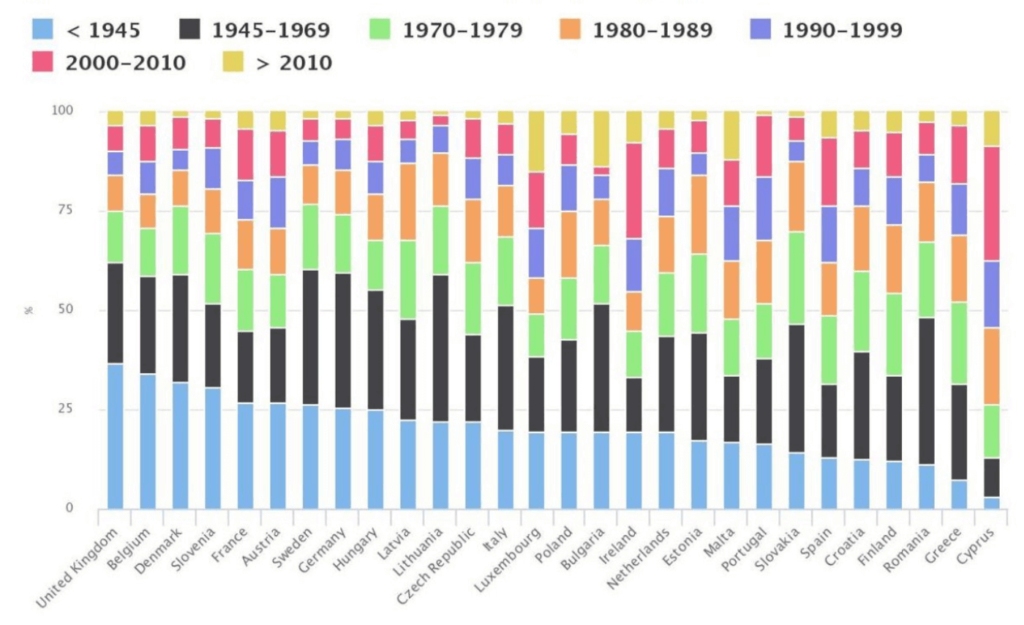

2/ And: the majority of the building stock in Europe was built post-WWII, as noted below. Meaning, a large percentage of the building stock has several decades of lifetime ahead.

3/ Ergo: We have to consider the lifetime value of the building stock to really determine how to best address the carbon emissions of buildings. The remedy is different for 30 years vs. 120 years.

What unique challenges does this 100 year old factor present, then?

4/ There is no easy solution to refurbish the existing housing stock to high energy efficiency standards. This is compounded by the skilled labor shortage, increasing demand, and Europe being the de facto leader in some circles to lead climate-related changes.

5/ And: This is highlighted in the fact that the German government is raising government subsidies to support refurbishment efforts up to 40% of capital invested (via grants, implicit value of loan, or other external financial support). Simply exchanging the heating unit isn’t going to drastically reduce emissions to meet targets.

6/ And: Of the 41% of CO2 emissions coming from the construction and built environment sector, 26% of that is from the emissions post-construction over the lifetime of the building. Considering the lifetime differences between the three regions, this means that the average building in Europe is emitting these excessive emissions post-construction for 4x longer than in Asia and 2x longer than in North America.

7/ Ergo: Europe, we have a problem. There will not be the same level of new build at higher efficiency standards as there will be in Asia and North America, so the need to find an effective way to refurbish the existing housing stock is more important now than ever before.

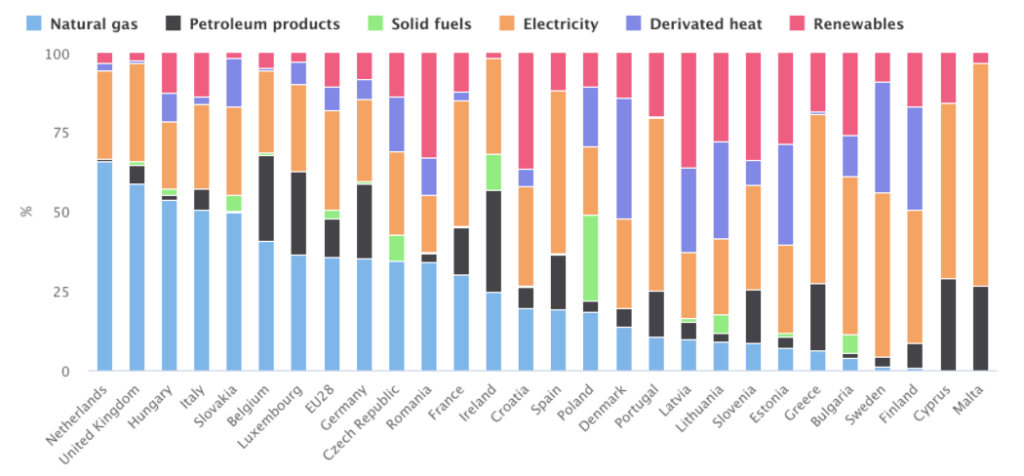

8/ And: A large number of European countries still use a substantial percentage of natural gas and petroleum products for energy consumption, so the carbon problem isn’t going away imminently.

Not all hope is lost, right?

9/ There is hope and more attention focused on net zero buildings — buildings where the amount of energy consumed by the building is equal to the amount of renewable energy produced by the building on site. The operation of the building, therefore, does not generate greenhouse gases.

10/ Ergo: While the residential building stock isn’t going away anytime soon, the spotlight on the need to ramp up refurbishment in a cost-efficient way has just started to shine brighter. There is opportunity for first movers (i.e. our portfolio company Q-Bot) to grab market share and take advantage of the large subsidies that aren’t going away any time soon.

Europe could adopt the North American or Asian approach and shorten the lifetime of its building stock. In this, there would need to be a strong mandate to build with green materials for new builds (and recycle the materials of the old, demolished building stock). The more realistic option, rather than large-scale demolition of existing stock with decades of life remaining, is to identify, implement, and scale a solution that fits the needs of this specific region. The market is large enough to build that/those “unicorn/s” that we all hope for in the VC industry. Let’s see what happens….

Thank you (!) to the Foundamental Insights team for uncovering unique nuggets of information for this article.

References: