BNPL: These 4 letters have dominated tech news the past few months. Headline after headline, funding round after funding round.

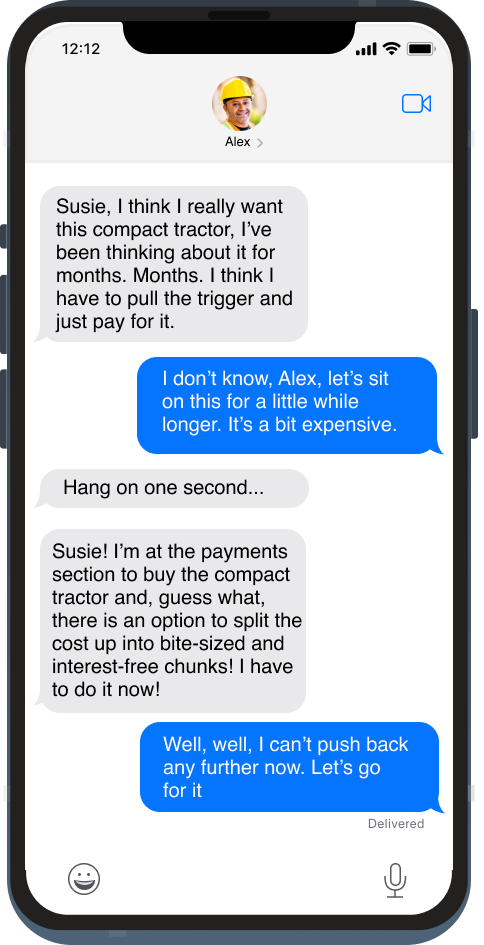

The “buy now pay later” phenomenon and craze has taken the tech industry by storm giving consumers the flexibility to break purchases into equal installments and buy products interest free. We have spent the last couple of months evaluating whether this ecommerce phenomena would be applicable to the construction world, but before doing so, we needed to understand the foundations of what has made BNPL so successful.

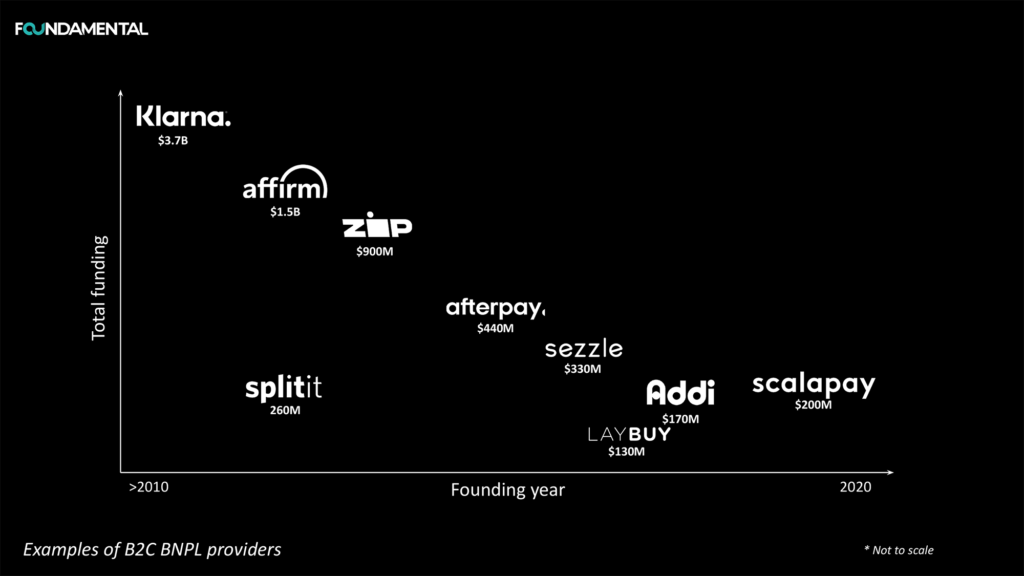

The rush of optimism and interest in companies such as Klarna, Afterpay, and Affirm that offer “buy now, pay later” has accelerated during the pandemic. These players are able to feed off the data acquired so that they can better assess who is able to pay back a loan and get business from customers that were previously excluded from using credit cards, but perhaps were no less credit-worthy.

A market hack, we’d say.

BNPL isn’t entirely risk-free since it’s still a line of credit that can influence credit scores and trigger debt collectors in some cases. Nevertheless, BNPL accounted for 2.1% of global e-commerce in 2021.

With e-commerce continuing to grow, consumer expectations have radically changed, and ´Buy Now Pay Later´ has been one of the pivotal solutions to respond to that change, by seamlessly integrating as a checkout option, and offering consumers no interest, and sometimes, no late fees. Adoption is booming, particularly among Gen Z and Millenials, and merchants love it, as a means to boost sales, improve conversion at checkout and even save on interchange fees.

In the years BNPL has become a Trojan horse for taking on payments as a whole. While the beginnings of Klarna were coined by the unbundling of services, today the Sweden-based quadricorn runs the full checkout facility for their partners, not just as a credit plugin, proving that BNPL players are key contenders in joining the billion dollar ranks in the fintech ecosystem.

At least VCs seem to think so: funding in BNPL has grown from just $110M in 2016 to $4b+ in 2021 YTD. There are now 170+ startups competing in the BNPL space, with new players being born every month.

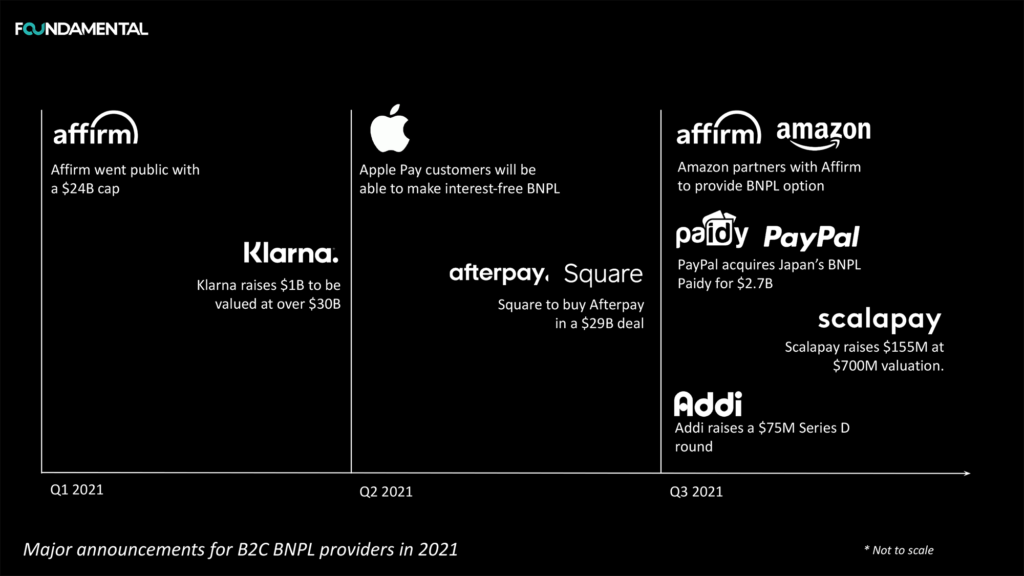

And the craze does not seem to have an ending:

But the journey doesn’t stop there…

So we’ll get to the construction angle. But, before that, we need to dive into B2B and why this model sets the stage for any type of “buy now pay later” in construction.

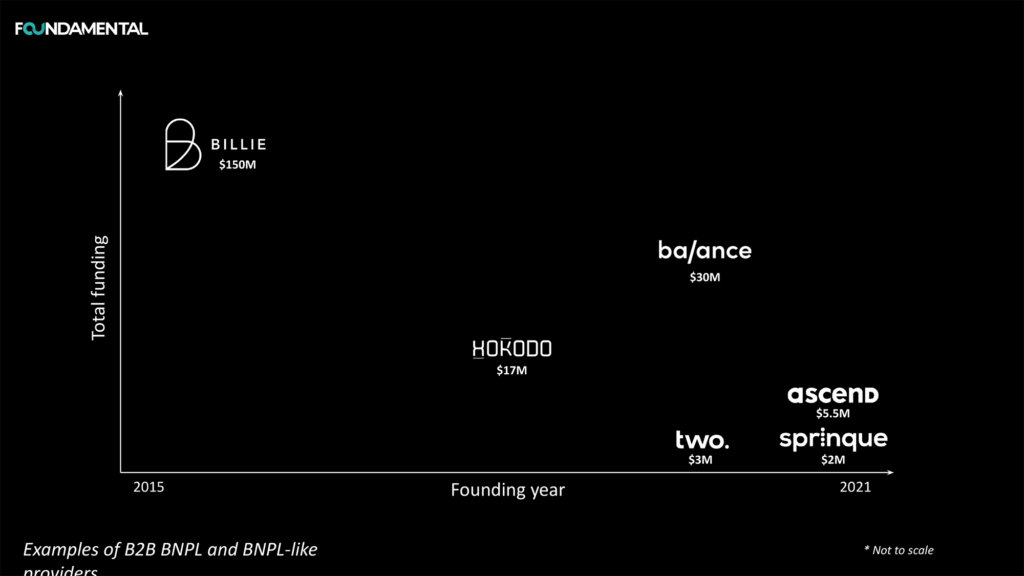

Where do B2B models fall into the grand scheme of BNPL and holistic repayment options for merchants and their customers? Well…

Business buyers want the same digital experience they get as consumers and business merchants are looking for every opportunity to make their customer relationships stickier, increase average order size, and capture a larger share of wallet. The market is grossly underserved, with startups like Berlin-based Billie, recently raising an €86M Series C round, tapping into this huge opportunity.

Arguably more important is that small business buyers need access to affordable credit and financing options. Financing has always been a challenge for small and medium-sized businesses (SMBs), and COVID has only exacerbated the problem (interestingly, this makes up over 80% of the construction industry)!

Until COVID, a surprising percentage of B2B commerce still took place partially or entirely via traditional channels such as in-person sales, assisted selling, distributors, and phone. In fact, approximately 80% of B2B payments continue to be made via check. And 40% of businesses report that online purchases are more complicated to make than traditional purchases.

The problem wouldn’t be as exciting if there weren’t challenges to overcome. B2B BNPL will likely take some time before it catches up to the widespread popularity B2C BNPL has achieved, namely because:

Now, let’s get to the nitty gritty…. 😉

Even less talked about is how can the construction industry take advantage of BNPL or similar or similar business models to solve major pain points plaguing the industry.

Hello Let’s set the stage for why construction would benefit (and is patiently waiting) for a BNPL-type solution.

What is even going on here?

Wow! It’s surprising that this still happens in 2021.

The construction industry is dominated by progress payments, which are payments paid out based on the percentage of work that is complete. Contractors and subcontractors will typically request progress payment via a payment application in order to request payment from the hiring party and are submitted according to the contract timeline.

The benefits here are that owners and general contractors can review the work of subcontractors before it’s complete and resolve disputes in a timely fashion. The subcontractors, who in many cases are cash flow-constrained, can receive payments before the project is completed, making cash flow easier to predict and control and they can avoid taking on unnecessary debt.

The downside is the time needed to put together the application at multiple points during the project. There can also be disputes between the general contractor and subcontractors around how much of the project has actually been completed, which could cause unnecessary delays or filing of liens. BNPL can further facilitate the movement of payments between construction parties.

What has been done with regards to BNPL in construction?

But the industry is not completely unfamiliar with BNPL. In Europe, for instance, BNPL is informally adopted by construction SMBs mostly twice per year – right before summer vacations start and right before Christmas starts. Convenient, you may think… But: the reason was not that the SMB went on holiday, rather that their clients did so and the contractors found out that over that period they would tend to wait 30-45 days longer for their invoice payments AND had 2-3x higher rate of missing the invoice payment altogether.

Moreover, with vertically specialised BNPL moving in other markets, we have seen the emerging of solutions penetrating our world from the consumer-side. Wisestack, who has raised $45 million, has brought buy now pay later to in-person home services (think HVAC repairs and plumbing). The company even goes head on with the fragmented nature of the industry by accessing the professional customer base of vertical SaaS providers, such as Jobber.

What should be done?

So where do we go from here? We see the value of productizing BNPL in construction payment flows so as to increase its continuous vs. cyclical use, and facilitate its entry into complex B2B workflows. As validators rather than predictors, we want to pool our insights from what we are currently observing in the market:

BNPL may not be the silver bullet that solves all the payments delays and cash flow constraints that plague the industry, but it can be suitable in many cases allowing subcontractors and suppliers to be paid in a timely fashion and for work to proceed as anticipated, further enabling an on time and on budget project delivery.

Time will tell to what extent the industry will adopt this solution. It may be targeted at specific business models (i.e. home improvement or equipment marketplaces) or see further penetration into more traditional payment workflows. We strongly hope that the B2B BNPL wave doesn’t miss out on the multi-trillion dollar opportunity in construction. If anything, it should be one of the first adopters.