We are four months into 2021. As the year-end holidays are approaching in big steps – time to do the first review, isn’t it.

While absolutely nothing about 2020 and the start into 2021 has been normal (COVID, anyone?), the last few months gave us many reasons to be optimistic about 2021 and beyond for PropertyTech (PropTech) and ConstructionTech (ConTech). We realized that 2020 brought major milestones for the real estate technology sector:

2020 had also shed some light on where PropTech and ConTech stand in the bigger picture compared to other sectors. There is a strong recurring pattern we can apply to the real estate tech sector: it takes 5-7 years for a sector to go from $5B to $50B of venture capital (VC) funding. There is usually accelerating growth in this pattern, as the step-up from $10B to $50B only takes 2-4 years while the step-up from $5B to $10B takes the other 2-4 years within that time frame. That pattern is extremely reliable:

PropTech had reached the $50B mark at the end of 2020. ConTech is probably going to shatter the $10B barrier in the next few weeks. From here, it might be a vertical ride for both real estate tech sectors.

And then, let’s also not forget what COVID meant for ConTech and PropTech in 2020. COVID created scenarios in multiple global markets in which commercial properties have come under market pressure, and owners, developers and investors have to find answers. It also created a scenario in which the residential asset class has seen even more transactions than ever – and also reallocations between residential markets which initiated bigger shifts and created new opportunities. For example, folks leaving the US Bay Area for other places to live because they now can.

Sounds like lots in store. Quo vadis from here though?

These are good reasons for us to have four insiders take a (controversial) look at which sector they expect to flourish in 2021 and beyond – and why.

With that in mind, we ask our four insiders: Will the next year be the year of ConTech or PropTech?

It’s an interesting question. When you look at the funding numbers above, PropTech is more advanced as a sector. On the other hand, ConTech looks poised to break out. Both attractive features for a sector.

As an early stage investor, I’m slightly biased towards a sector breaking out as a whole (ConTech). That’s not to say there won’t be deals and companies in PropTech that will be breakouts in the next years anymore – there absolutely will be. But a sector breaking out as a whole is a different game.

Imagine you had committed to invest in early stage FinTechs in early 2011. At that point, FinTech was at ca. $9B funding-to-date – which is where ConTech is as we write this. FinTech crossed the $50B mark in 2014, meaning it took FinTech pretty much exactly 3 years to get from $9B to $50B – which is in line with the patterns shown above. If you had a strategy dedicated entirely to FinTech, and you had built a good early stage portfolio dating back to 2011, you had an above-average chance of making excess returns by benefiting from the 5x influx of capital. A similar bet can be made for ConTech right now (and less so for PropTech).

Same goes for founders, by the way. If you’re a founder looking to found again in 2021, one big criterion for you certainly is to go where the money will be inflecting 5-10x right now. That is ConTech.

So that’s one macro view for 2021. A second macro view is to look at which asset classes PropTech and ConTech are serving, and how those asset classes are doing this year.

Almost all PropTech addresses two asset classes: residential and commercial buildings. On the ConTech side, we see a wider range of asset classes addressed: residential, commercial, infrastructure, industrial and renovation. I expect and hope ConTechs to become a bit more concentrated in the near-term, ip. on residential, infrastructure and renovation. Commercial assets will probably stay under pressure in 2021. On the one hand, that should create new asymmetric opportunities for great founders in PropTech and ConTech (just check out Reef Technology‘s last round and how the Reef model might pop up in multiple countries now with commercial/retail assets under water). On the other hand, I like that ConTech has a broader range of assets to build value for, which I expect to make ConTechs quite resilient and provide more opportunities for asymmetric growth. On this point it’s mostly a tie for me, but I’m leaning slightly towards ConTech having a few more asymmetric opportunities in 2021 from the multiple asset classes.

So, just staying on a macro level, much to like about both sectors, but I would (and do) bet my own money on ConTech inflecting more from here on.

I could go on here with more arguments, such as CO2 reduction potential and the role technology plays in improving either sector, but I’ll save that for a second round of debate 😉

We have invested in several PropTech startups and one construction tech company. I guess that serves as a good descriptor for what has been happening. As a generalist VC, we’re free to look broadly across sectors. Our attention gets drawn to where we see the largest opportunities – and we’re definitely spending a lot of time in construction at the moment. We’re also observing cooling interest around some sub-sectors of PropTech. The strongest founders are currently looking at or starting in the construction space vs. PropTech. It seems like the next 1-2 years will be the time for construction technologies. However, that doesn’t mean that the interesting opportunities in PropTech are over. I’d say: far from it.

Over the last years, we saw the emergence of winners in PropTech in several categories and the consequential funding explosion. First, there was a clear opportunity in the classifieds space, followed by another one in the brokerage space. Look at ImmoScout24 in Europe, Zillow in the US, Homeday in Germany, Opendoor in the US, Casavo in Italy, Compass in the US and now Evernest in Germany. It’s important to notice that the main drivers were consumer expectations on the seller & buyer side. That’s usually where technological adoption happens earliest and fastest. Amazing entrepreneurs identified the right timing for choosing a problem that’s still “pretty hard to do, but not impossible”. Defining what this is in a given industry is a complex function of technological capabilities, stakeholders’ willingness to adopt new models & technologies, fragmentation of the market, the role of incumbents, etc.

The funding explosion in PropTech also was, in line with Power Law, largely attributable to a few winners – including the anomaly that was WeWork. A large chunk of these multi-billion dollars of funding went to only a handful of companies. A lot of others, trying to hop on the PropTech bandwagon, didn’t do so well.

Sharing-economy models (Co-Living, Co-Working, etc.) were promised to be the next big thing – but proved more difficult to scale than many have thought. Equally, many other models in PropTech have been having a harder time. For example, I have not seen many smart-building and IoT-solutions companies really take-off – until now. COVID prompted property managers with huge problems around understanding usage and processes around their buildings. So, where formerly the problem wasn’t pronounced enough to stir up demand, this is now changing. These large shifts in an industry – economical, legal, technological, etc. – they determine the inflection point for certain models.

I think in construction, the time is ripe. Stakeholders such as general contractors, real estate developers, yellow machine OEMs, etc. are looking for methods to digitise their processes, optimise, and automate. To use the old analogy: the fruit is hanging lower now. Strong, entrepreneurial talent is moving into the space. Capital influx is increasing. We’re seeing first potential breakout cases. Procore, PlanGrid, and some others. We will see decacorns emerge, which will further accelerate interest in the space. It’s a good time to be a tech founder in construction. But it’s likely to be equally good in PropTech. Of course, only if you’re betting on the right model.

Let me start from a completely different viewpoint than Patric and Enrico. Consider this:

Many roof tiles today usually still have some sort of bend in their shape, which goes back to the Romans who put the wet clay over their thigh to mold it. This is certainly an extreme example (although I think a quite entertaining one) of the rate of innovation seen in construction and – as always – there have been many examples of tremendous technological innovation in the industry over time. However, it does exemplify to a certain extent a degree of inertia and resistance to change that is quite inherent in the construction and building materials industry as a whole.

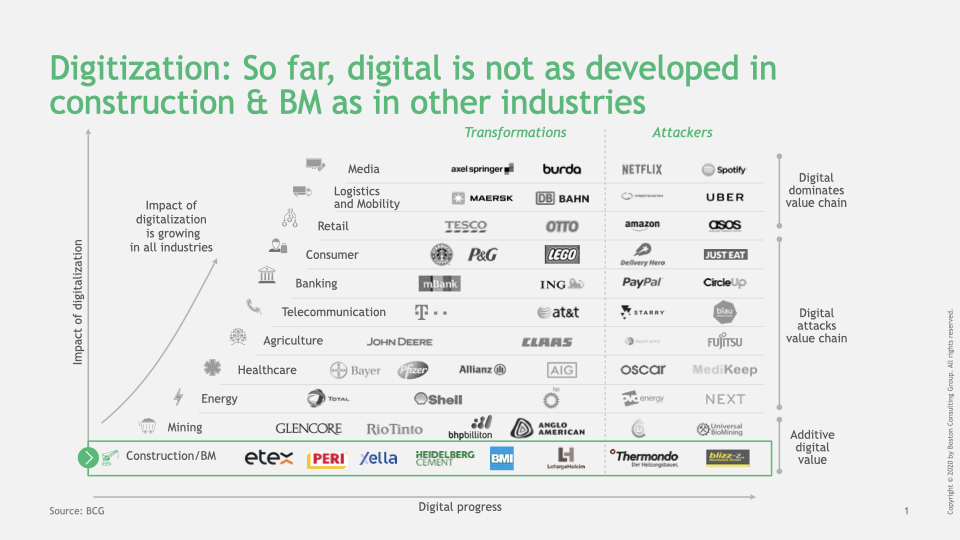

Across the value chain, the adoption of digitalization has been extremely poor over the last decade, making construction a digital laggard, while other industries (consumer goods, healthcare, banking) have thrived significantly: It starts with the producers of building materials who are at large still struggling with how to forge a direct path to the end-consumers via digital means, distributors who run websites that look like they have not been updated since the early 2000s and finally construction companies that are planning highly complex processes based on hand-made XLS-sheets, mainly driven by the predominant paradigms of the industry: cost discipline, uncertainly avoidance, incremental improvements, fast ROI.

While there are of course examples of construction organizations have started to integrate such innovations as robotics, onsite drones, and building information modeling into routine construction it is fair to say that these are baby-steps and we are still quite far away from a mass-adoption of such techniques. As an example, German-based PERI has received a lot of praise for completing the first 3D-printed multi-family-home in Germany at the end of 2020 – while this is a true milestone in (European) construction (especially since PERI is actually a supplier of formwork systems, not a construction company!), demonstrating how completely new construction technology can change traditional construction practices, we are talking about one building only at this point, so there is still some way to go until being able to do this at scale. Also when it comes to innovative business models, industry-changing moves have been rare. Katerra, the much-praised US-based company that has gained a lot of attention in the last years because of their approach to integrate the entire value chain from design to erecting buildings, cutting out the distributors along the way and thus seemingly creating a new standard procedure, has burnt through $2B in financing and had to be bailed out by a $200M injection from Softbank to survive – not the best marketing for the new business model the company tries to establish for sure…

The picture changes, however, when going one step further in the value chain and also the lifetime of a particular building, now moving beyond erecting a building to running and servicing a building that already exists and further to managing the transactions of real estate thereafter – developing and including technology-aided / digital solutions with the general objective to make life for the inhabitants of those buildings more comfortable has become more or less standard procedure, starting with simple things like wireless scanners for remote measuring of heat consumption all the way to integrated, intelligent “smart building” solutions that are becoming the standard for new buildings. Similarly, Patric and Enrico have already alluded to the many good examples of already successful plays geared around, e.g., the brokerage and classifieds space.

Looking at the current dynamics outlined above, I would thus argue that from a practitioner’s perspective, construction is not yet at an inflection point towards exponential adoption of new business models, technology and digitalization. I also believe that the COVID-context will not fundamentally change the trajectory here, also because the social distancing restrictions we had to live with for almost a year now have mainly spurred solutions to avoid interactions between a household and everything outside the household – so, again, rather the PropTech space – while the construction process itself remained largely unaffected (in fact, the Construction industry was one of the few exceptions that carried on in most countries even during the strictest phases of the lockdown). This may of course be driven by the fact that the work is actually being performed outside and thus infection risk is minimized significantly in this context – on the flipside, this also minimized (and still does) the need and urgency to find new solutions for working together that are different from before COVID.

So contrary to my two co-writers before, from a practitioner’s perspective on the ground in the market, I would rather put my money on PropTech than on ConTech for the next years – even more so in the current context of COVID and at least until someone comes up with a fresh idea of what a roof tile could look like.

First of all, I’d like to respond to Lucian’s illustration and add my point of view: Knowing it stands symbolic for the industry’s alleged inertia, it’s not decisive whether the roof tiles are given a new shape. It has been used over centuries and has proven to be practical, economical to produce, easy to transport and simple to replace. Certainly, today there are other ways to protect a roof from weathering. But the real question is rather complex: Will we find a way to plot the roofing digitally? Can we enable software to automatically calculate material requirements, compare price-performance ratios and evaluate thermal insulation? And one step further: Will we be able to teach robots to lay the fragile bricks independently in the future? My prediction: Yes, we will. In ConstructionTech, we certainly still have a comparable long way to go – but that also means we can easily start on a new page and flip the industry on its head.

The situation is somewhat different in PropertyTech. Here we’ve already walked a large part of the distance quite successfully. In B2C and C2C, prosperous business models have emerged all over the world – from classifieds like German Immobilienscout24, sharing economy companies like AirBnB, to “wholesalers” like Opendoor, or InsurTechs like Hippo. However, all of the above can be seen as “classic” tech companies which have transferred the platform idea, already well established in many other industries, to the real estate sector. Still, these models aren’t less attractive to investors like VCs or family offices – the first PropTech-focussed SPACs are an impressive evidence. However, this was the comparatively easy part of the trail with low-hanging, ripe fruit along the way.

In PropTech’s B2B sector, I still see a huge need for development. Currently, most of the players only offer partial solutions to complex problems instead of thinking new and holistically. To have a lasting impact on the industry, the software solutions should consider and map the entire life cycle of a building to find end-to-end solutions that accommodate the needs of as many market participants as possible – benefiting owners and users, facility and property management. Particularly in the areas of Smart Buildings and Internet of Things, the full potential has not yet been exploited. Perhaps it is bold to think that one company can do it all by itself. But to take life-cycle thinking into account, start-ups should at least work with APIs. A software that can be easily integrated into an existing system automatically contributes to the big picture.

As a construction and real estate entrepreneur, I naturally watch both PropTech and ConTech very closely. However, since design and construction is the significant larger part of our business, I am perhaps a bit more passionately involved here. Unlike PropTech, ConTech requires far greater expertise to find actual digital solutions to complex challenges – for example optimizing the many interlinked processes at construction sites or automizing machinery in constantly changing environments. This is new territory and copycats don’t stand much of a chance. For the transformation, real construction know-how and engineering savvy have to be lumped together with tech knowledge. That alone is challenging. Just imagine how rarely a Silicon Valley Techie finds himself on a major construction site asking the question: Can’t we find a way to technologize the bolting of exterior wall panels? And how likely is it that a Software Developer teams up with a Construction Manager to develop software-driven solutions to efficiently document construction progress? Some companies, including Aeditive, have successfully set up interdisciplinary and competent teams: Experts from architecture, engineering, materials science, robotics, simulation and programming have joined forces. Other best practices are HILTI with their Jaibot, Okibo from Tel Aviv or Built Robotics and SafeAI – former Tesla, Google, Apple and Stanford guys have teamed up with construction people and are automating construction the Silicon Valley style. And this is where things are getting interesting! All mentioned are well on their way to exploiting the innovation potential of the construction industry.

And with that in mind, I am approaching the answer to the initiatory question “will the next year be the year of ConTech or PropTech?”. I am convinced: the time is ripe for both! The property sector was relatively easy to digitise “out-side in”. As a result, PropTech is more advanced and already at a fairly high level. As we are still a long way from market consolidation, now it’s time to professionalize the offering and increase the breadth and depth of services. ConTech, on the other hand, is still at the very beginning but about to break out. The segment is highly complex, but just as high is the potential for exciting innovations to change the game for good. What is required from start-ups is the desire to really understand the industry and to go beyond the simple equation “hardly digitized, easy to improve”. Therefore, start-ups should interlock with ACEs at a very early stage in order to start with the right problems, jointly looking for new ways to overcome them. Close cooperation only will support developing solutions that later fit through the door. Needless to say, but of course the market that can be tapped is enormous. I believe ConTech will make a big leap in 2021 and thus catch up to a degree – however, we have 10-20 years of significant value chain transformation in front of us which will allow the bold movers to benefit from tremendous new value pools.

Alright. 4 roles, 4 viewpoints. So what is the one right answer on whether the next year will be the year of ConTech or PropTech?

Honestly, none of us know – and that’s the great part. After debating about this question for a while, we all realized: the opportunities are massive in both sectors. And that’s the exciting part. PropTech seems to provide more opportunities for additional efficiencies on top of some groundwork of digital infrastructure that has been laid.

ConTech is earlier in its lifecycle and represents a big breakout opportunity as a whole.

Meaning: it’s a good time to be alive in both sectors!

If you are a founder, or consider founding, in either ConTech or PropTech: We want to hear from you. Drop us a line!

We ❤️ ConTech . We ❤️ PropTech.